About UsLong-Term Vision and Mid-Term Business Plan

In May 2021, Sawai Group drew up a vision for the future that we want to aim for by fiscal year 2030, “Sawai Group Vision 2030,” and we formulated a new medium-term management plan, “START 2024,” for the first three years toward realizing that vision. In addition, we have formulated and announced the next three-year medium-term management plan, “Beyond 2027,” in June 2024.

Sawai Group Holdings established its corporate philosophy of “Dedicated to building a healthier future for all,” which will be our guide for what we exist for, how we work and where we are heading. Also, we have set and will aim to realize our ultimate objective of "realizing a sustainable society through the generics business" and "contributing to the extension of healthy lifespans through new businesses."

Dedicated to building

a healthier future for all

- Working to resolve social issues

through Sawai Group businesses - Realizing a sustainable society through the generics business

Contributing to the extension of healthy lifespans through new businesses

We will strive to contribute to the health of as many people as possible as a healthcare corporate group developing sustainably alongside society, with the generic drugs as our core business.

Our Long-term Vision,

“Sawai Group Vision 2030”

To create a world where more people can receive healthcare services and live a full life with peace of mind, we strive to become a company that continues contributing to people's health by providing products and services based on scientific evidence that meet individual needs.

Sawai GroupVision 2030

-

The World We Want to Build

A world where more people can receive healthcare services and live a full life with peace of mind among society

-

Our Ideal State

A company with a strong presence that continues to contribute to people's health by providing a multifaceted mix of products and services based on scientific evidence that meet individual needs

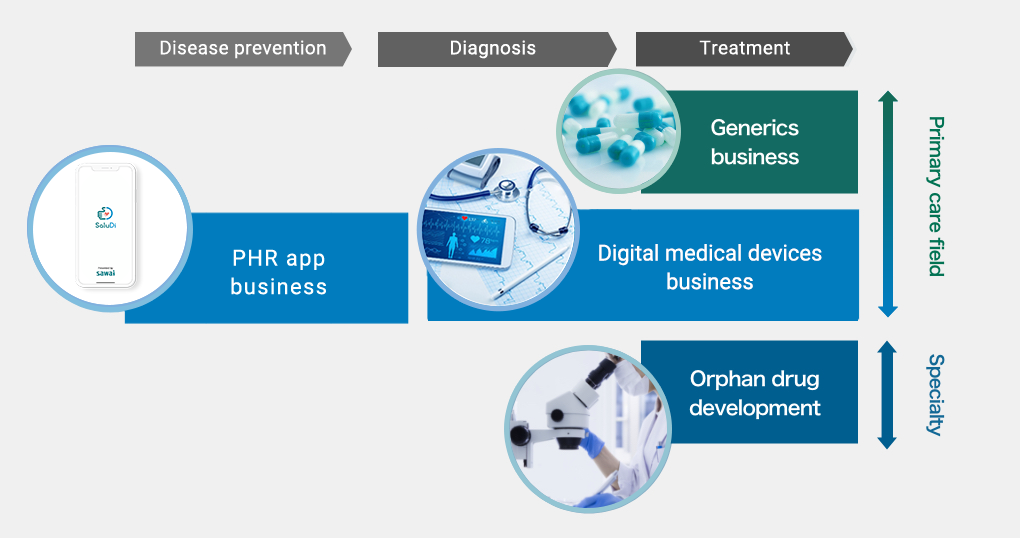

Business Development

We will take on the challenges of new businesses with the generics business as our core. As a leading company in the primary care field of generics, we aim to provide a wide range of options ranging from prevention to treatment, not limited to drug therapy. We will also enter the new drug development business in the rare diseases field in order to provide unprecedented treatment opportunities.

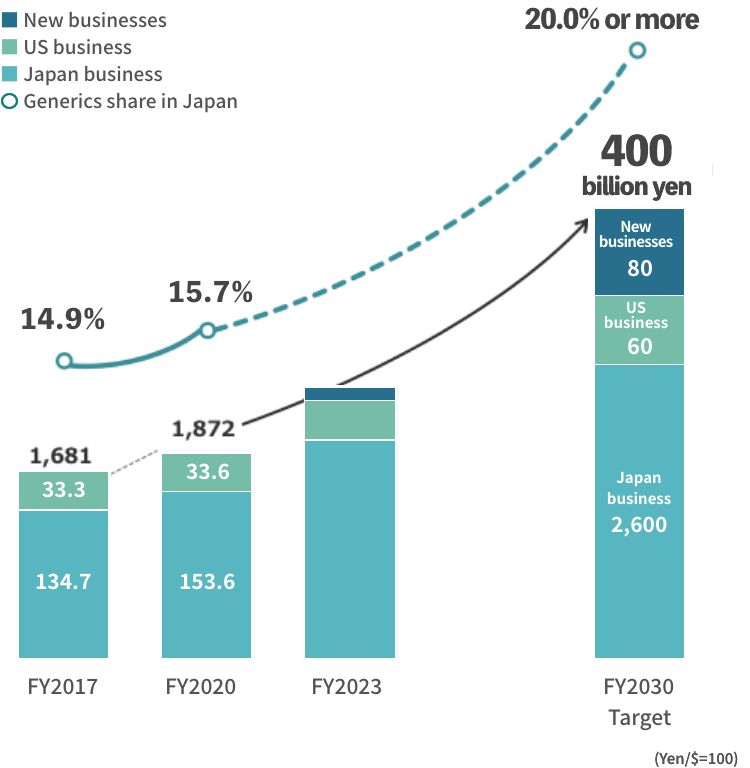

Quantitative Targets

| FY2017 Actual |

FY2020 Actual |

FY2023 Actual |

Vision 2030 for FY2030 |

||

|---|---|---|---|---|---|

| Japanese generics business |

Revenue | 134.7 billion yen | 153.6 billion yen | 176.9 billion yen | 300 billion yen |

| Sales volume |

10.6 billion tablets |

13.3 billion tablets |

15.7 billion tablets |

24 billion tablets |

|

| Share of sales |

14.9% | 16.1% | 17.1% | 25.0% or more | |

| Production capacity |

15.5 billion tablets |

15.5 billion tablets |

18.5 billion tablets |

25 billion tablets or more |

|

| New businesses |

Revenue | – | – | 0.01 billion yen | 10 billion yen |

| US business |

Revenue | 33.3 billion yen | 33.6 billion yen | Discontinued operation |

– |

| Total revenue | 168.1 billion yen | 187.2 billion yen | 176.9 billion yen | 310 billion yen | |

| ROE | – | 5.8% | 6.6% | 13% or more | |

| ROIC | – | 4.3% | 4.8% | 10% or more | |

The generics market is expected to experience an average annual growth rate of approx. 0.7 billion tablets per year, due to the aging population.

We aim to expand our share in generics market by increasing sales volume at a rate that outpaces market growth through enhanced production capacity.

Medium-term Business Plan “Beyond 2027”

-

Key themes for business strategy

-

1Achieving steady growth in the generics market

-

2Establishing sustainability of the generics business

-

3Continuing investment in growth areas

-

-

Key themes for management base

-

1Creating talent that underpins sustainable growth

-

2Working on sustainability initiatives

-

3Improving capital efficiency

-

Establishing a trusted corporate foundation

We take the administrative penalty we received last year very seriously. Placing top priority on recovering trust of patients and medical professionals, we will fully comply with laws and regulations and implement thorough recurrence prevention measures.

- Carrying out Corporate Culture Reform Project*

- Reassessing the existing products from manufacturing and quality perspectives, and implementing corrective measures

- Implementing recurrence prevention measures in the Manufacturing Division

- Implementing recurrence prevention measures at Kyushu Factory

- Implementing recurrence prevention measures at the Reliability Assurance Division

Business Strategy 1 & 2:

Achieving Steady Growth and Business Sustainability in Generics Market

Capturing current growth opportunities without fail, while making sustainable contribution to society as social infrastructure with the pride of being a leading player in the generics industry.

Steady growth

Capturing current growth opportunities by leveraging the production capacity expanded through investments during the period of the previous Medium-term Business Plan and paying close attention to the tailwind generated by reform of the drug price system

Specific measures

- Develop and launch new products steadily

- Improve the utilization rate and increase production at production facilities in which we have made investments

- Expand market share of profitable products

- Provide peace of mind and added value that medical professionals and patients need

Growth investments

- Continue to make top-tier R&D investments in the Japanese generics industry (for the development of new products and the improvement of existing products)

- Refurbish production facilities with top-tier production capacity in Japan

- Expand production capacity during the period of the current Medium-term Business Plan (through measures such as capital investments and alliances with other companies)

Establishment of business sustainability

Establishing a business model that allows for a stable supply of generic drugs, which are integral part of social infrastructure, over the many years to come

Specific measures

- Sell at reasonable prices

- Manage unprofitable products

- Conduct research and development in view of products’ lifecycles

- Continue to expand production capacity in the period of the next Medium-term Business Plan and beyond

Growth investments

- Expand production capacity during the period of the next Medium-term Business Plan and beyond (through measures such as capital investments and alliances with other companies)

Business Strategy 3:

Continuous Investment in Growth Areas

Contributing to the extension of healthy lifespans through new businesses

Digital medical devices business

Project segments

SWD001 (non-invasive neuromodulation device, Relivion®)

- Migraine: Marketing and manufacturing approval obtained in FY2023. Sales planned for start in FY2024.

- Depression: Considerations planned for application for approval in Japan, after the completion of clinical studies in the US.

SWD002 (DTx for NASH)

- Phase 3 study started in January 2024. Launch planned for in FY2027.

SaluDi (PHR app)

- Accelerating deployment to medical institutions to use it as digital sales promotion material. Continuing consideration for monetization.

When to start contributing to sales revenue

FY2024

FY2027

During the current Medium-term

Business Plan period

Project segments

SWD001 (non-invasive neuromodulation device, Relivion®)

- Migraine: Marketing and manufacturing approval obtained in FY2023. Sales planned for start in FY2024.

- Depression: Considerations planned for application for approval in Japan, after the completion of clinical studies in the US.

When to start contributing to sales revenue

FY2024

Project segments

SWD002 (DTx for NASH)

- Phase 3 study started in January 2024. Launch planned for in FY2027.

When to start contributing to sales revenue

FY2027

Project segments

SaluDi (PHR app)

- Accelerating deployment to medical institutions to use it as digital sales promotion material. Continuing consideration for monetization.

When to start contributing to sales revenue

During the current Medium-term

Business Plan period

Generics export

Project segments

China and ASEAN region

- Consideration underway to expand overseas in cooperation with local partner companies

When to start contributing to sales revenue

During the current Medium-term

Business Plan period

New drug business (Orphan diseases)

Project segments

Orphan Drugs

- Exploration for new pipelines underway

When to start contributing to sales revenue

-

Strengthening Business Foundation 1:

Producing Talented Personnel to Support Sustainable Growth

Achieving the Group’s mid- to long-term growth through the promotion of talent acquisition and development, which is most important for business management, amid a decreasing working population.

Developing talent

High-priority measures

- Secure talent for production, quality assurance, and research

- Utilize diverse personnel

- Develop talent with a management perspective, etc.

Main action plans

- Strengthening capability to recruit new graduates and mid-career workers.

- Establishing attractive working conditions with an eye on the work environment.

- Appointing and utilizing diverse talents such as women and the elderly.

- Continuously developing successor candidates based on the succession plan.

Work styles / motivation, respect for human rights

High-priority measures

- Reform corporate culture (create an open atmosphere in the company)

- Promote inclusion, diversity, and equity (ID&E)

- Encourage flexible work styles

- Enhance engagement in the human rights area

Main action plans

- Increasing opportunities for dialogue between management and employees.

- Regularly investigating employees’ engagement and implementing measures for improvement.

- Continuously developing female department heads and managers.

- Reaching for 100% utilization of childcare leave.

- Introducing a system to work from remote locations.

- Supporting employees’ independent career development through internal job postings and parallel career paths within the company.

- Implementing education and training on the human rights area using e-learning and other tools.

- Utilizing the corporate ethics helpline.

Strengthening Business Foundation 2:

Initiatives for Sustainability

Addressing ESG issues including measures to address climate change, promotion of ID&E, and strengthening of corporate governance, as a healthcare corporate group which develops sustainably alongside society.

EEnvironmentally friendly production

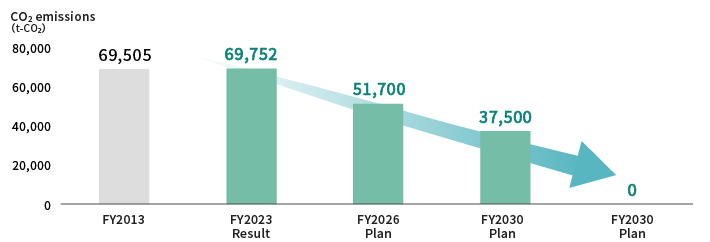

Reducing total emissions volume 46% compared to FY2013+α level by 2030. Achieving net zero by 2050.

Quantitative targets, etc.

- Compared to FY2013+α level,

- 46% reduction of total emissions volume (FY2030)

- Net zero CO2 emissions (2050)

- 3% reduction of water usage intensity (compared to FY2023)

- Waste plastic recycling rate of 65% or more (2030)

Key measures through FY2026

- Utilize non-fossil certificates.

- Increase capital investment in energy saving equipment such as energy saving air conditioners.

- Introduce further solar power generation.

- Consider switches to energy sources with lower environmental loads (e.g. from heavy oil to gas).

- Understand the current water usage and consider further water saving.

- Consider a switch from thermal recycling to material recycling.

- Reduce both total emissions and emissions per tablet by improving efficiency with larger lot sizes.

- Seek to transform waste into valuables.

- Work with business partners to develop raw materials that are both low carbon and low cost.

- Strengthen information gathering to introduce new technology more actively than ever before.

STalent development, work styles / motivation, respect for human rights

Quantitative targets, etc.

- Employee engagement indicator score of 4.50

- Ratio of women in managerial positions of 15% or more, Ratio of women in department heads or upper positions of 10% or more

- Men’s utilization of childcare leave of 100%

- Percentage of employees with disabilities of 2.85%

- Initiatives on human rights due diligence

Key measures through FY2026

- Support employees’ independent career development. (systems that enable employees to transition to new positions voluntarily, opening of a career consultation counter, etc.)

- Implement onboarding measures to prevent the resignation of young employees.

- Continuously develop female leaders.

- Enhance childcare environment further by introducing new leave options for childcare purpose, and other measures.

- Increase recruitment of people with disabilities.

- Understand the human rights practices of business partners and work together.

- Spread the understanding that respecting human rights leads to corporate sustainability.

GDeepening corporate governance

Quantitative targets, etc.

- Stronger risk management/compliance

- Strengthening of supply chain management

- System formulation ensuring trust in non-financial information

Key measures through FY2026

- Strengthen the Risk Management Committee and the Compliance Committee.

- Review purchasing GL of Sawai Pharmaceutical, and revise it into the Group’s purchasing GL.

- Grasp business partners’ ESG practices through questionnaires to them.

- Document the calculation process for non-financial information and conduct risk assessment.

- Enhance information security.

Strengthening Business Foundation 3:

Initiatives to Improve Capital Efficiency

Using KPIs more conscious of capital cost to improve capital efficiency. Revising shareholder return and dividends policy.

Proactive use of KPIs conscious of capital cost

- Set a target ROE surpassing capital cost

- Set a target ROIC surpassing WACC

- Set target net DE ratio and shareholders’ equity to total assets

- Clarify the investment criteria with an awareness of profitability, cash flow and capital cost by the Group Investment Committee

- Further enrich ESG leading to sustainable growth and capital cost reduction

- Invest in non-financial capital, including intellectual capital and human capital

- Pursue efforts on periodic analysis of PBR and PER, and continuous improvement measures

Shareholder return and dividends policy after revision

The Company's basic policy for shareholder return is to provide stable and continuous dividends, taking into account overall medium- to long-term profit levels, DOE, etc. while balancing shareholder returns with investments that will lead to new growth, including R&D and capital investments that will contribute to future corporate value enhancement. We aim to improve capital efficiency and enhance shareholder returns by flexibly purchasing treasury shares based on free cash flow, market trends, and other factors.